Did Congress Change Tax Rules To Schedule F Get The 20% Deduction Of Income For 2024

Did Congress Change Tax Rules To Schedule F Get The 20% Deduction Of Income For 2024

If you are looking for (Answered):QuestionMel Snow is the manager of a firm, Taxation Matters you’ve visit to the right page. We have 15 Pics about (Answered):QuestionMel Snow is the manager of a firm, Taxation Matters like (Answered):QuestionMel Snow is the manager of a firm, Taxation Matters, China releases tax rate schedule for year-end bonuses – CGTN and also Common Tax Benefits under Section 80C of Income Tax Act 1961 With. Here it is:

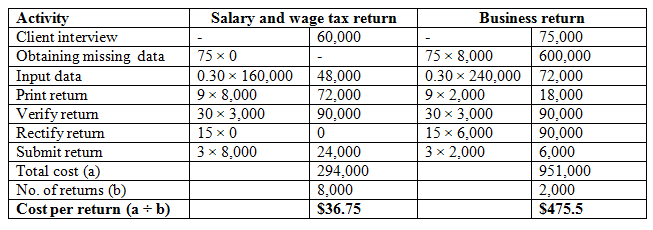

(Answered):QuestionMel Snow Is The Manager Of A Firm, Taxation Matters

Photo Credit by: studywaive.com

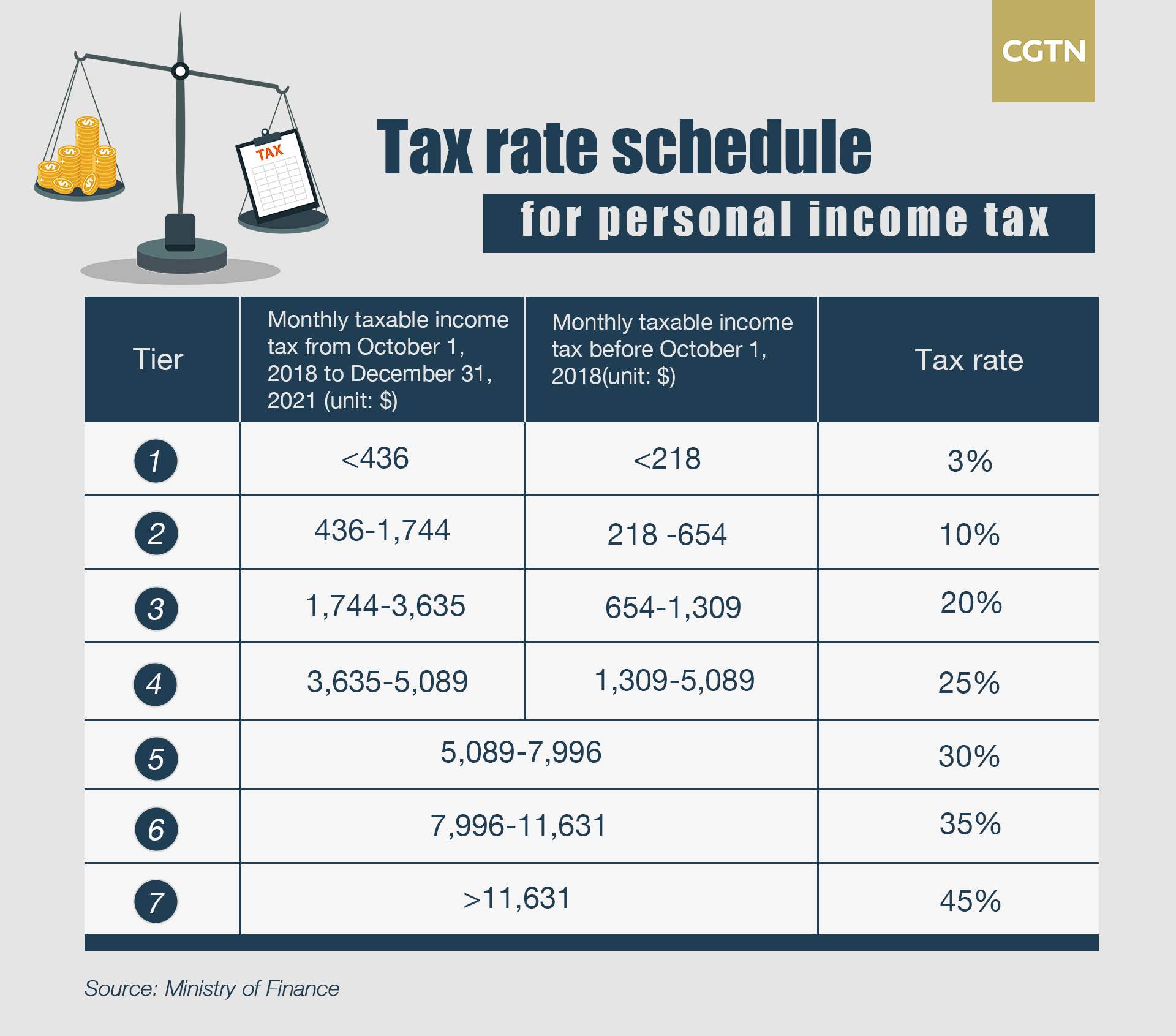

China Releases Tax Rate Schedule For Year-end Bonuses – CGTN

Photo Credit by: news.cgtn.com bonuses income individual cgtn thursday

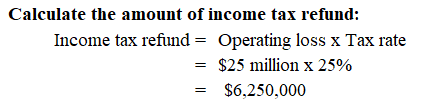

(Answered):QuestionInsure Corporation Reported A Net Operating Loss Of

Photo Credit by: studywaive.com

Change In Income Tax Rules Effective From April 1st, 2021!!

Photo Credit by: mutualfundpatna.com

Did Congress Really Eliminate The Marriage Tax Penalty? Part 1

Photo Credit by: ifstudies.org tax

On The New Eportal Of Income Tax Dept., Under Column – PENDING ACTIONS

Photo Credit by: incometax.quora.com

Untitled Document-15.pdf – Why Did Congress Have So Much Trouble

Photo Credit by: www.coursehero.com

Hra Exemption Calculation As Per Income Tax Act – TAXP

Photo Credit by: taxp.blogspot.com income fy deductions ay calculation exemption hra

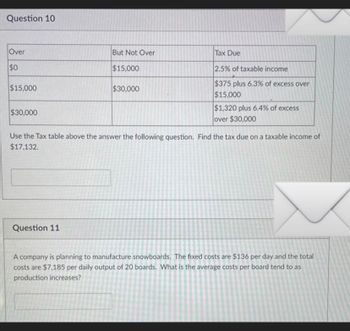

Answered: Over $0 $15,000 $30,000 But Not Over… | Bartleby

Photo Credit by: www.bartleby.com

Income Taxation.docx – Income Taxation Rex Banggawan 2021 Chapter 1

Photo Credit by: www.coursehero.com

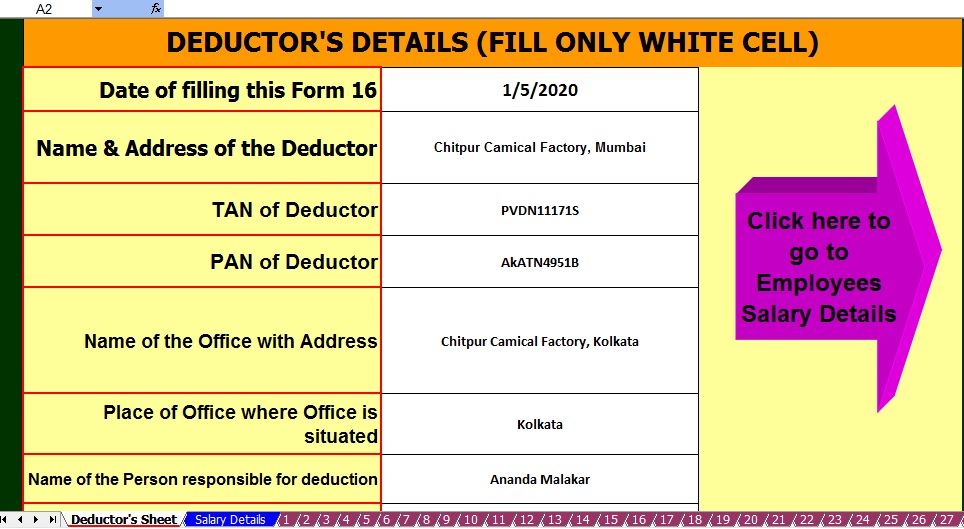

Higher TDS Deduction If Income Tax Return Not Filed For 2 Years | ITR

Photo Credit by: www.e-startupindia.com tds deduction filed

Section 127(3)(B) Income Tax Act : Any Remuneration As Defined In

Photo Credit by: baddayst.blogspot.com

Deduction Of Income Tax On Withdrawal Of P.F. 60%

Photo Credit by: 90paisa.blogspot.com income withdrawal deduction tax council staff national side

Deduction For Medical Insurance Premium U / S 80D| With Income Tax

Photo Credit by: itaxsoftware.blogspot.com deduction assam 80d preparation

Common Tax Benefits Under Section 80C Of Income Tax Act 1961 With

Photo Credit by: smiletax.in revised automated prepare

Did Congress Change Tax Rules To Schedule F Get The 20% Deduction Of Income For 2024: (answered):questionmel snow is the manager of a firm, taxation matters. Did congress really eliminate the marriage tax penalty? part 1. Bonuses income individual cgtn thursday. Revised automated prepare. Income taxation.docx. Income withdrawal deduction tax council staff national side